FY 23 Budget Q&A #004: What impact would health insurance increases have on proposed compensation increases?

Budget Question # 004: What impact would health insurance increases have on proposed compensation increases? Please provide the health insurance premium change for employees (for each plan tier) based on the projected increases for United Healthcare and Kaiser. Please provide the fiscal impact of possible one-time scenarios to cushion the impact of this increase on employees, including the fiscal impact if the City were to fund a 1-month or 2-month health insurance premium holiday for all employees. Please include analysis as to whether this one-time expense would be eligible as an expenditure of American Rescue Plan Act funds. (Mayor Wilson, Councilman McPike, Councilman Chapman)

Response:

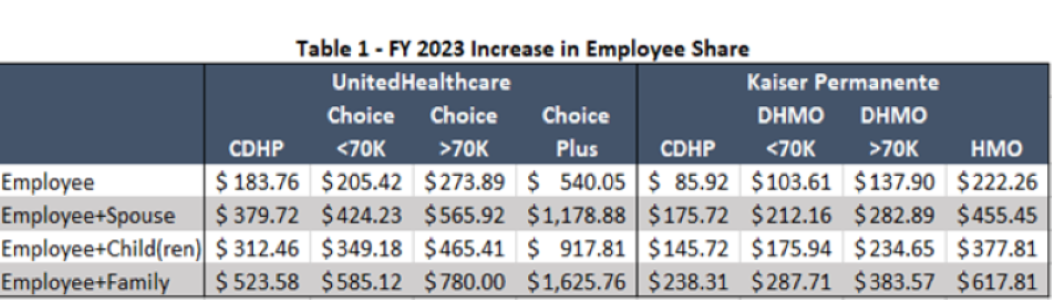

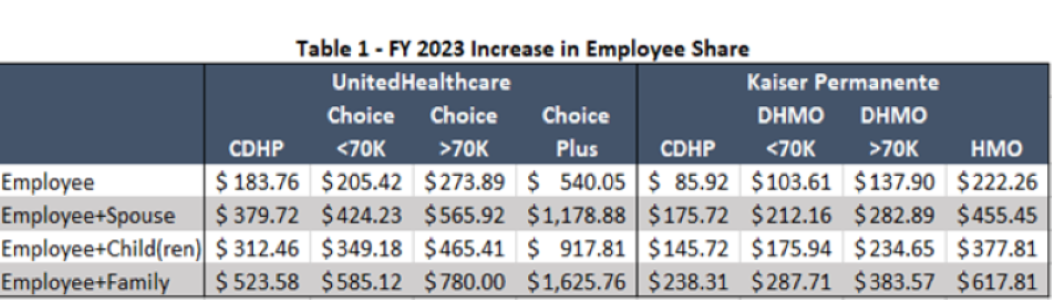

Health insurance premiums increases received just prior to the release of the FY 2023 Proposed Operating Budget were estimated to increase by 15.6% for United Health Care plans and 9.0% for Kaiser Permanente plans in FY 2023. The annual increase in the employee share for the basic plans ranges from a low of $85.92 annually for the Kaiser Permanente employee-only Consumer Driven Health Plan (CDHP) to a high of $780.00 annually for employees who select the United Choice family plan. The City funds 80% of the cost of the basic plans for employees earning $70,000 or more per year and 85% of the cost of plans offered to employees earning less than $70,000 per year. Employees who choose the costliest United Choice Plus and Kaiser HMO plans pay higher premiums and a greater percentage share of those premiums.

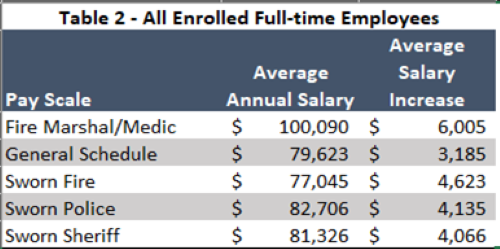

Table 2 shows the average salary for all full-time employees who are enrolled in health plans within each pay scale and the pay adjustment on that average salary. It does not include the value of step increases, which vary based on the employee’s placement on the pay scale and the date on which they are received.

To cushion the impact of the health plan increase on employees, staff would recommend one of the following options:

- Option A (Preferred): The City would cover the cost to the employees' health plan for two pay periods (1 month). The cost to the City would be approximately $500,000 and could be paid for by ARPA funds given that the pandemic is one of the key factors in the increase. The result of this action on the employees would be an 8% decrease in the costs an employee would pay for the health plans offered by the City.

- Option B: The City would cover four pay periods (2 months) of employee cost which would be about $1 million dollars and could also be paid by ARPA funds. The result of this action on the employee would be a 15% decrease in the costs for employees.