FY 23 Budget Q&A #068: What would be the impact of increasing the elderly and disabled real estate tax relief program limit on assets, excluding the home, from the current $430,000 to Arlington County’s $585,880?

Page updated on September 20, 2024 at 11:13 AM

XWARNING: You have chosen to translate this page using an automated translation system.

This translation has not been reviewed by the City of Alexandria and may contain errors.

Budget Question # 068: What would be the impact of increasing the elderly and disabled real estate tax relief program limit on assets, excluding the home, from the current $430,000 to Arlington County’s $585,880? Please provide a projected breakdown of the $5.5 million budgeted for relief in FY 2023. (Mayor Wilson)

Response:

Of the $5.5 million estimated for Tax Relief in FY 2023, approximately $2.9 is for the City’s program for the Elderly and Disabled. The remaining $2.6 m. is allocated for Disabled Veterans and the spouse of veterans killed in action as required by State law.

As to matching Arlington’s maximum net asset level of $585,880, staff lacks asset data from which to forecast a precise estimate. Given that caveat, staff’s best estimate is that the impact could possibly add around 19 applicants and “defer” up to $140,000 in annual tax revenue.

Arlington County’s maximum asset level for tax “relief” is only $433,935. Depending on an applicant’s income, they will allow a tax “deferral” for applicants with net assets up to $585,880.

Arlington has a larger population than the City (237,107 v. 158,675), and their Elderly and Disabled program serves 894 participants (of which 25 are tax deferrals based on either income or assets). This compares to the City’s 684 tax relief participants. The relative relationship suggests we could add around 25 additional applicants for deferral:

684/894 = 76%

25 Arlington deferrals x 76% = 19 City deferrals

At the average assessed value of residential property in FY 2023, or $655,901, and the existing tax rate of $1.11 per $100 of assessed value, that works out to the potential deferral of around $140,000 per year.

However, participation may not reach that level since historically deferral has not been heavily utilized, presumably because the deferred taxes remain a lien on the property that must be paid upon sale or by the owner’s estate upon demise.

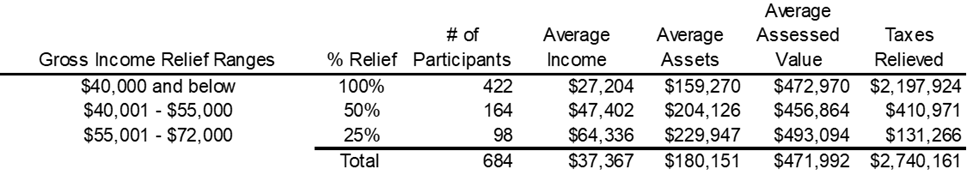

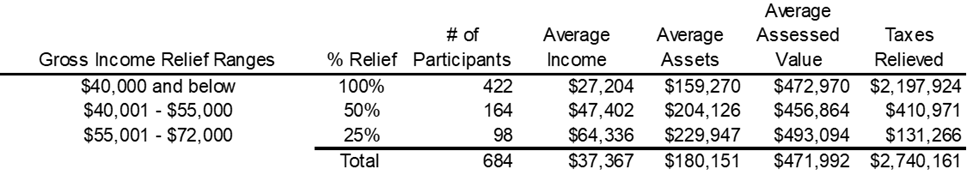

The City currently relieves approximately $2.7 million in Real Estate taxes for Tax Year 2021:

For those at the 50 and 25 percent relief levels, owners are allowed to defer the remaining amount of taxes. However, for Tax Year 2021, only 9 of those at the 50 percent level and 3 of those at the 25 percent level chose to defer the remaining taxes.

Similarly, the City already allows Elderly and Disabled taxpayers with gross income between $72,000 and $100,000 (and net assets up to $430,000) to defer their taxes. To date, only one Elderly or Disabled taxpayer takes advantage of the deferral program. While participation is low, this option does provide a valuable safeguard should someone in this demographic face an urgent cashflow problem.

Staff cautions against making this same extrapolation should Council desire to increase the “relief” cap to $585,880 in net assets. Participation from that type of change could be higher.

For perspective, in Tax Year 2021, staff denied 25 applications based on income or assets. Of these, 9 were denied because of excessive net assets, with an average of $543,285. Of these, 6 were below $585,880. However, we do not know how many potential applicants never applied because they knew the existing parameters. Extrapolating from 2020 census data, staff roughly estimates there could be around 6,100 owner occupied residential units in the City where the owner is 65 years old or older.

Printable Version