FY 23 Budget Q&A #002: What are the budget and policy implications of various clean fuel vehicle tax options?

Page updated on September 20, 2024 at 11:17 AM

XWARNING: You have chosen to translate this page using an automated translation system.

This translation has not been reviewed by the City of Alexandria and may contain errors.

Budget Question # 002: What are the budget and policy implications of various clean fuel vehicle tax options? (Councilwoman Gaskins)

Response:

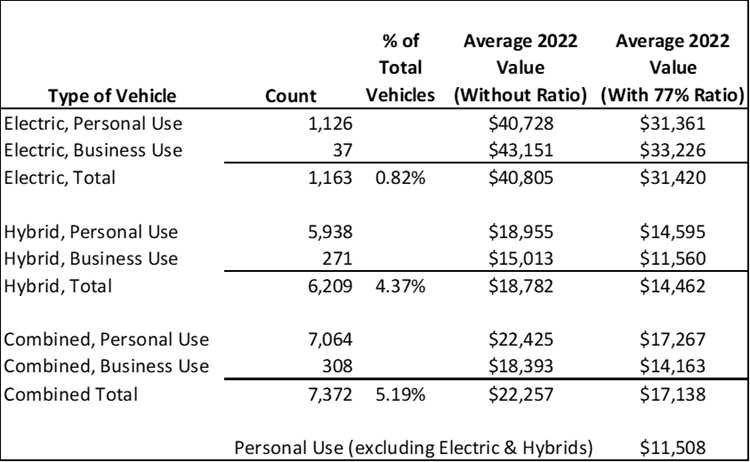

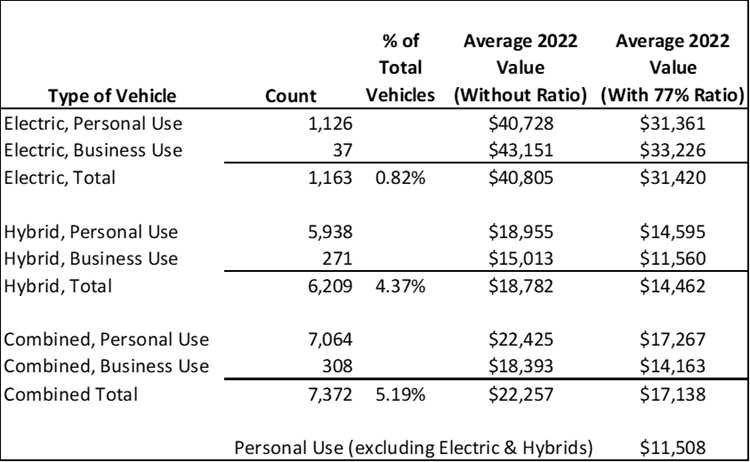

Staff has identified the following vehicles in our tax base as of the end of calendar year 2021:

-

1,163 Electric or Electric Plug-In vehicles

-

6,209 Regular Hybrids (battery and gas powered)