Center for Economic Support | FY22 Community Impact Report

The Center for Economic Support guides Alexandrians in accessing a range of human service programs and benefits, works to reduce homelessness and the impact of the eviction crisis, operationalizes strategies to address food scarcity and helps people obtain training and employment.

Food Security Programs

Food Security programs, funded by ARPA, provided resources to meet the increased demand of families facing food insecurity due to income and supply chain issues. A newly created Food Security Coordinator position was developed to oversee food security efforts including gathering data on needs, creating a baseline report on food security and food access in Alexandria, and partnering with community organizations to connect all eligible Alexandrians to SNAP and community food resources. Non-profit partner ALIVE! purchased produce directly from a vendor that packaged items for safe distribution during events and provided culturally appropriate food items.

The Office of Community Services (OCS) and The Partnership to Prevent and End Homelessness

The Office of Community Services (OCS) and the Partnership to Prevent and End Homelessness, partnered with local hotels and the Department of Recreation, Parks and Cultural Activities to establish safe emergency shelter services during the continued pandemic.

OCS partnered with refugee resettlement agencies to provide rent relief for Afghans who came to the U.S. in August 2021. Resettlement agencies paid three months and OCS paid an additional 3 months of rent relief for each family. The Afghan Resettlement Agencies formally recognized the City of Alexandria for its collaboration.

Point in Time (PIT) Count

The Annual Point in Time (PIT) Count of people experiencing homelessness in the City of Alexandria identified 120 persons experiencing homelessness, a 13% increase from the 2021 PIT Count, believed to be due to loss of COVID-related funding to keep people housed during the pandemic. The PIT results help convey the scope of homelessness, identify and assess unmet needs and gaps in services, inform funding and other planning decisions, and evaluate progress made in preventing and ending homelessness.

Eviction Prevention Task Force

The Eviction Prevention Task Force, an inter-agency collaboration, has prevented 54% of pending evictions since the Task Force inception in 2020 through outreach in high eviction areas and in the courthouse, linkage of households to legal and other resources, and a range of long-term eviction prevention strategies.

Workforce Development Center

The Workforce Development Center (WDC) received funding, after several years of advocacy by the community, to hire a full-time 50+ Employment Training Specialist to focus on employment for individuals 50 years of age or older. This program served 187 people with services including case management, job search support, training, permanent job placement and the Work-Based Learning Initiative (WBL). WBL led to permanent jobs for six older adult Alexandrians at an average wage of $25.56 an hour. The 50+ program also created collaborations with local, state and national agencies that serve older adults. The WDC offered 10 different Career Readiness Workshops several times per week, including three held in Spanish, and facilitated 34 recruitment and hiring events.

Work-Based Learning Initiative

The Work-Based Learning Initiative (WBL) placed 72 clients of all ages with employers for learning opportunities. Of these, 64 clients have completed their Work Based Learning experience and 33 job seekers have since obtained Full Time employment, earning an average wage of $24.43 an hour. This program also helped mitigate the staffing shortages and resulting capacity issues experienced by community non-profits.

Free Income Tax Preparation Program

The Free Income Tax Preparation Program completed returns for 268 low-income taxpayers who received net refunds of $507,560 federal and $43,615 state. This program was supported by 16 tax preparation volunteers who worked 553 hours. Refunds included $195,591 in federal Earned Income Credit and $151,383 in Child Tax Credits. At an average cost of $268 for preparing tax returns, these residents saved $71,824 in tax preparation fees.

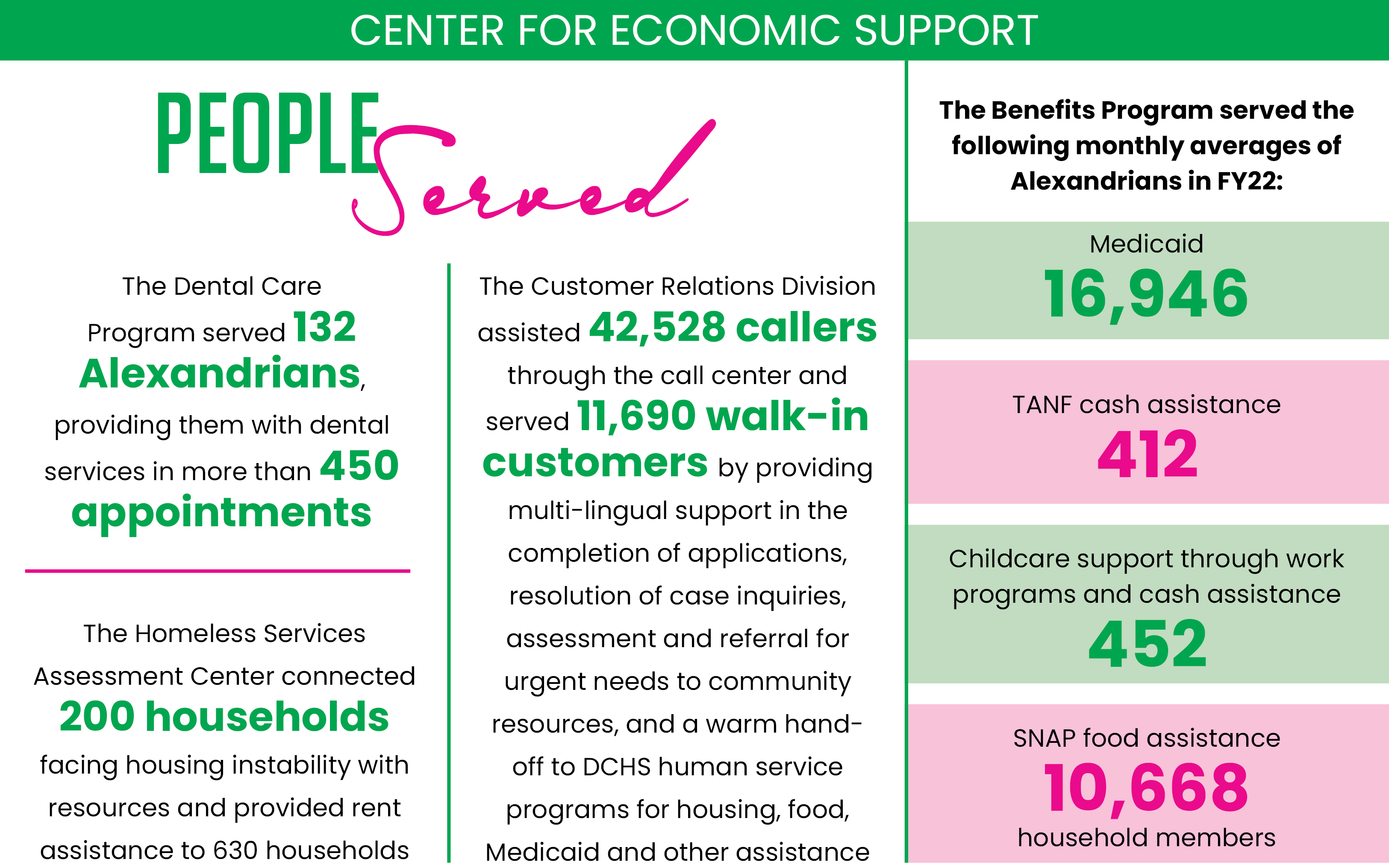

People Served

More Information

Learn more about employment and job training, benefit programs and housing and homeless services.