FY 25 Budget Q&A #078: Please provide a summary of Revenue Re-Estimates and Technical Adjustments for Add/Delete and recommendations for use of additional revenues.

Question: Please provide a summary of Revenue Re-Estimates and Technical Adjustments for Add/Delete and recommendations for use of additional revenues. (Morgan Routt)

Response:

City of Alexandria, Virginia

MEMORANDUM

DATE: MARCH 28, 2024

TO: THE HONORABLE MAYOR AND MEMBERS OF CITY COUNCIL

FROM: JAMES PARAJON, CITY MANAGER

SUBJECT: FY 2025 REVENUE RE-ESTIMATE, TECHNICAL ADJUSTMENTS FOR ADD/DELETE

The purpose of this memorandum is to inform City Council of the technical budget adjustments proposed by staff as part of the add/delete process, as well as the use of the additional revenues identified during this technical adjustment. This presents the final revenue and expenditure update before the add/delete process.

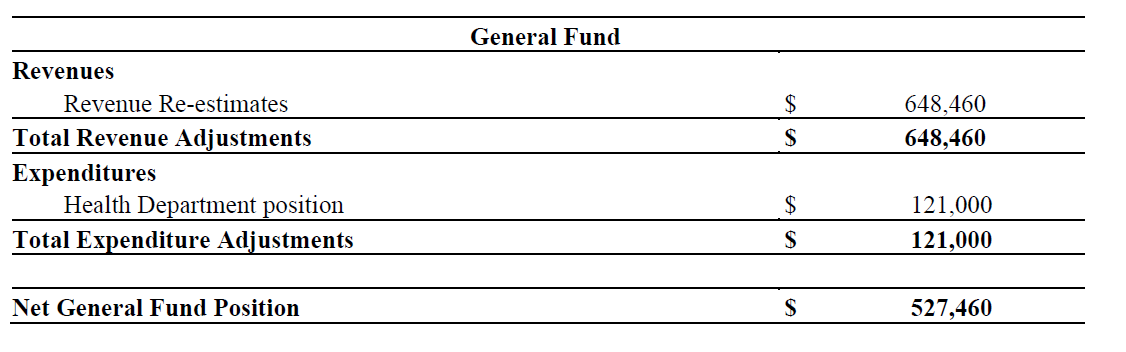

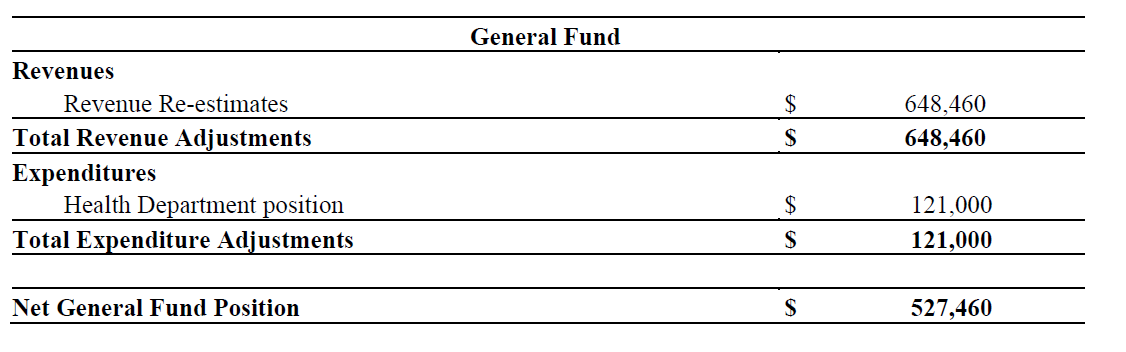

The sum of revenue re-estimate and technical adjustment expenditure changes provides a net General Fund gain of $527,460.

The major changes from the proposed budget are reflected in the chart below and discussed on the following pages.

General Fund Revenue Changes

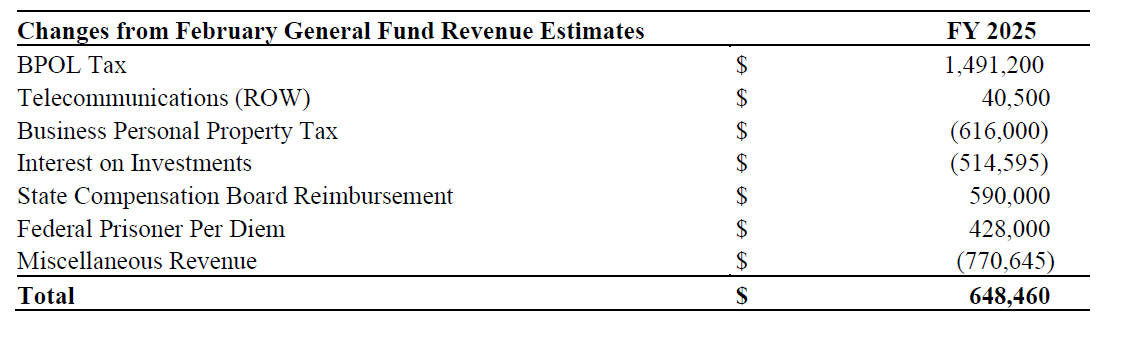

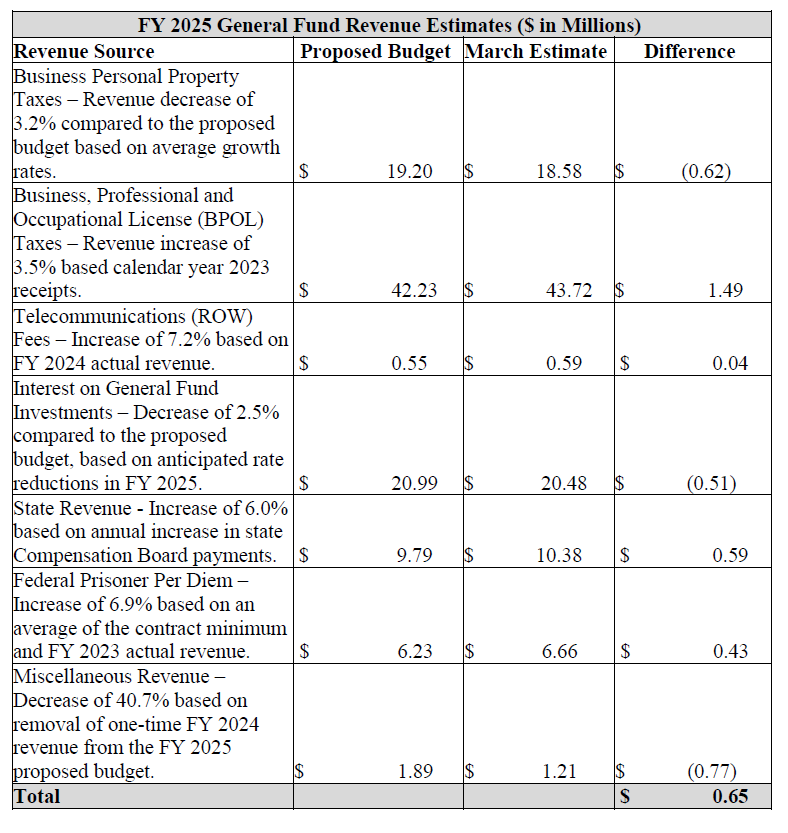

Annually, City staff re-estimates current fiscal year and subsequent fiscal year revenues based on additional months of collection data. The result of those projections shows an overall increase of $648,460 compared to the amount estimated in the City Manager’s Proposed Budget.

The table below includes the FY 2025 revenue estimation changes from February to March. Most of these changes reflect higher than anticipated tax collections for business, professional and occupational license (BPOL) taxes, telecommunications (ROW) fees, state compensation board reimbursement, and federal prisoner per diem which are offset by declines in business personal property tax, interest on investments, and miscellaneous revenue. The miscellaneous revenue category includes a $121,000 reimbursement for the Health Department position expenditure listed in the previous table.

The revenue re-estimates described in detail below reflect current tax rates and revenue policies continued or already reflected in the FY 2025 Proposed Budget.

The FY 2025 revenue estimates in the FY 2025 Proposed Budget were based on revenue collections and trends through December 2023. The latest estimates are based on revenue collections through February 2024, with exceptions as noted below. Based on actual receipts and trends through March, the FY 2025 revenue estimates have been changed as detailed below. These technical revenue adjustments will be reflected on the preliminary and final Add/Delete lists.

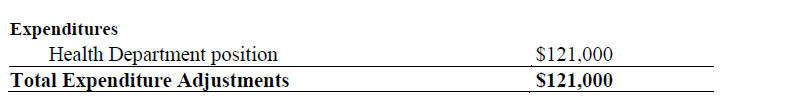

General Fund Expenditure Changes

The following FY 2025 expenditure budget change summarized in the table on page one was identified too late to include in the proposed budget or were identified after the proposed budget was released.

Health Department position: A State Health Department grant currently reimburses the City’s general fund for an IT Informatics Specialist position. As the grant was scheduled to end in FY 2025, the position was removed from the FY 2025 proposed budget. The Health Department has reviewed available grant funding and determined that there are enough grant funds to reimburse the City for the position’s expenses for all of FY 2025. The reimbursement has been included as part of the revenue re-estimate in the miscellaneous revenue category.

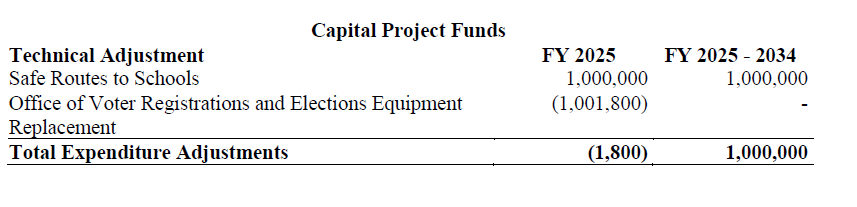

FY 2025 – FY 2034 Capital Improvement Program (CIP) Revenue & Expenditure Changes

The following CIP project changes were identified after the proposed FY 2025 – 2034 CIP was released and are recommended as technical adjustments in the final Approved FY 2025 – 2034 CIP.

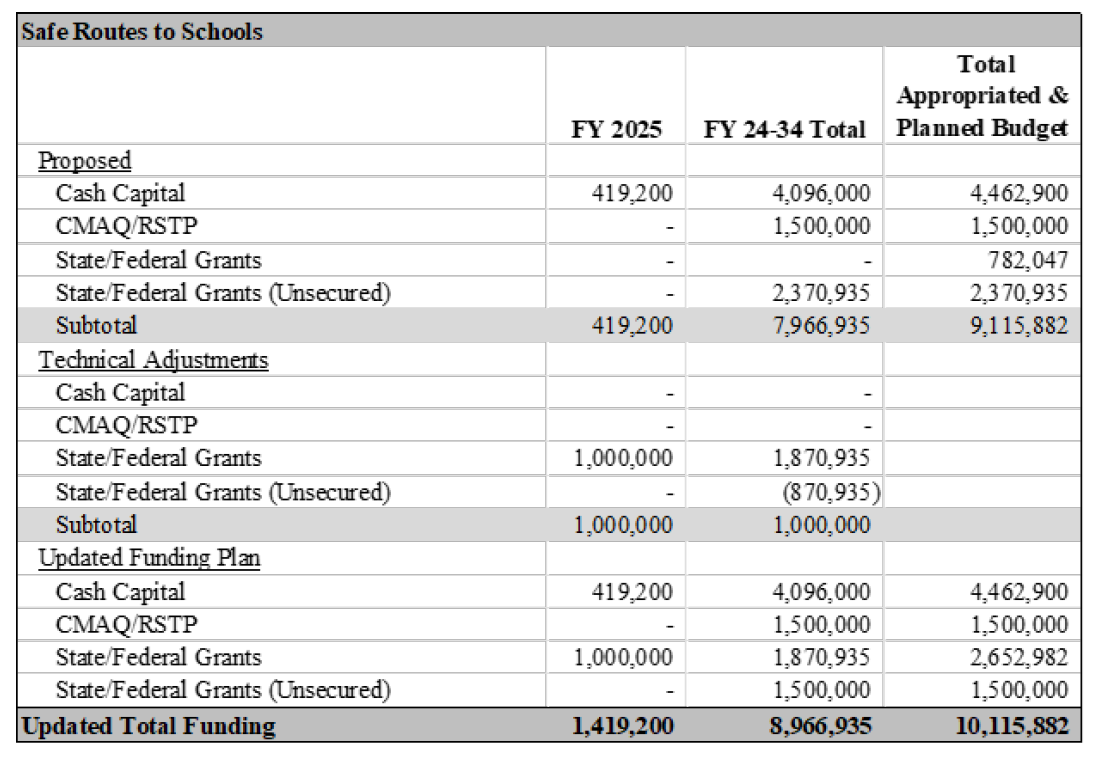

Transportation (Updated Grant Funding)

Subsequent to the presentation of the Proposed FY 2025 – FY 2034 CIP, the Virginia Department of Transportation’s (VDOT) grant funding for the Safe Routes to Schools project has increased by $1,000,000 and $1,870,935 in grant funding changed from “unsecured” to “secured”. Below reflects the changes made:

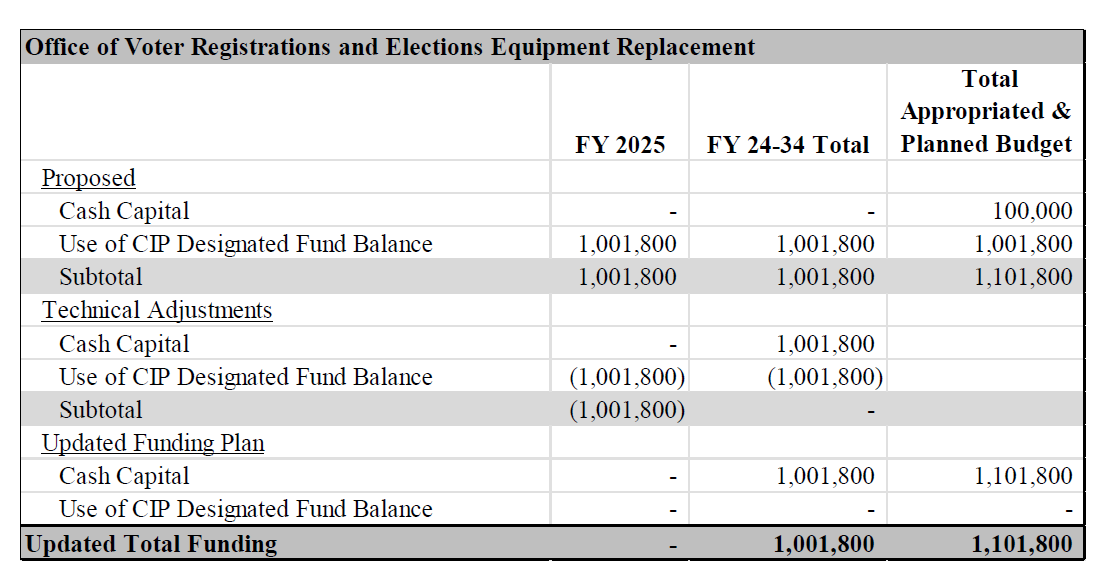

IT Plan

Subsequent to the presentation of the Proposed FY 2025 – FY 2034 CIP, staff were notified by the Virginia Department of Elections of an updated timeline for replacing voting equipment. Equipment replacement is now budgeted in FY 2026 instead of FY 2025. This results in a FY 2025 decrease in City unrestricted funding and corresponding increase in FY 2026. Below reflects the changes made:

Printable Version