Lump Sum Retirement Plan Change FAQs

FAQs

1. What is the Supplemental Retirement Plan?

The City created the Supplemental Retirement Plan (“Plan”) in 1970 to provide eligible full-time employees with greater monthly retirement payments than provided under the Virginia Retirement System (“VRS”). In 1999, the Plan also began providing retirement benefits for eligible part-time employees.

The basic benefit that the Plan provides is a lifetime monthly payment called a life annuity. At retirement, in place of the basic life annuity participants may choose an optional form of payment including a joint & survivor annuity, life annuity with guaranteed period of payment, or a lump sum payment.

The benefits provided by the Supplemental Retirement plan are unique to the City of Alexandria. Most jurisdictions participating in VRS do not receive an additional pension benefit.

2. What is the adopted change to the Supplemental Retirement Plan?

On May 4, 2017, City Council adopted a change to the calculation of the lump sum payment.

There is no change to how the plan calculates the monthly payment options offered by the Plan. Therefore, you will not be affected if you elect to receive a lifetime monthly payment at retirement.

Specifically, the change is to the interest rate used calculate the lump sum payment. The change will result in a decrease in the lump sum payment. The change will only affect participants who at retirement elect to receive the lump sum payment rather than a lifetime monthly payment. This change was adopted to ensure that the Plan is sustainable in its current structure into the future.

Additionally, the change does not eliminate the option to elect a lump sum payment.

The change does not affect VRS payment options including the VRS PLOP (partial lump sum payment option).

3. Is the lump sum payment option being eliminated?

The adopted change does not eliminate the lump sum payment.

4. Why was this change proposed?

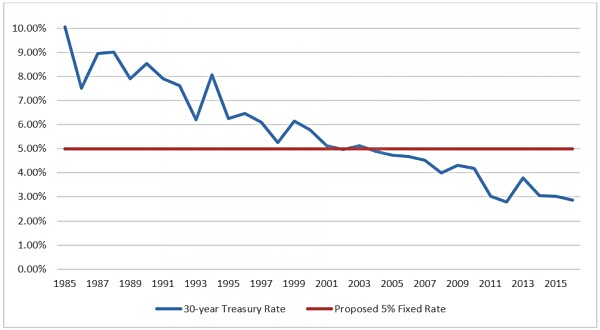

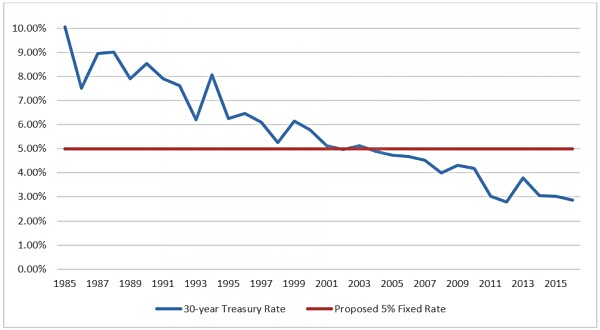

The Plan currently assumes that members can invest the lump sum payment at the 30-year U.S. Treasury rate (2.86% as of January), which is the rate of return for some U.S. government bonds. However, members often choose private investment vehicles that return much higher rates than bonds. As a result, the current lump sum option can be worth far more than the monthly payment options, which creates an unintended disparity between members. Since the Plan is investing its funds at actual market rates but calculating the lump sums based on unrelated rates, the Plan pays out far more than originally intended. This hurts the long-term sustainability of the Plan.

5. Who proposed the change?

This change was originally recommended to the City Manager by the Supplemental Retirement Board. The Board was created in 2012 and is made up of representatives of employees covered by the Supplemental Retirement Plan. See the pension web page for the list of Board members. The members of the Board serve as fiduciaries of the Plan and are primarily responsible for overseeing the investment of the Plan’s assets. The members of the Board recognized the strain that the lump sum payment in its current form is causing the Plan and thus recommended a change to the Plan. The Board considered several possible changes before submitting the change. The City Manager carried forward the Board’s recommendation to City Council.

6. Why was this change proposed at the same time as the FY 2018 budget?

The change amends the Supplemental Plan and is not part of the budget. However, the change results in a fiscal impact that needed to be reflected in order to keep the budget balanced. The City Manager proposed that the savings from this change be reallocated to add an additional step to employee salary scales.

7. Who decided whether to accept the change?

City Council is responsible for making changes to the Plan. The change was adopted by City Council in May 2017.

8. Should I be concerned that the Plan is in danger?

No, the Plan is not in danger. The City has a long history of funding the Plan and it is in good financial standing.

The assumed interest rate for lump sum payments needed to be updated because it did not match actual market rates. In its original form, the lump sum payment was straining the Plan’s assets. If no change had been adopted, other more drastic plan changes would have been necessary, such as benefit reductions, increased required contributions from all employees and the City, or even elimination of the Plan. Changing the assumed interest rate was a straightforward and fair way to address the problem.

9. How does the Plan calculate the benefits payable to each participant?

The basic benefit the Plan provides is the life annuity. The life annuity is calculated using a formula that includes salary, years of service, and a retirement multiplier determined by the Plan.

10. How is the lump sum payment calculated?

The lump sum payment represents the present value of the future monthly payments and is calculated based upon the 30-year U.S. Treasury rate as of January. The change substitutes a fixed rate of 5% for retirements during calendar year 2018, 6% for retirements in 2019, and 7.25% for retirements in and after 2020.

Here is a chart that compares the historical 30-year U.S. Treasury rate to the 5% fixed rate for 2018.

11. Does the change affect the amount of my life annuity?

No, the change will have no effect on the amount of your life annuity or how it is calculated. The change will also have no effect on the amount of the other monthly payment options including the “joint & survivor” annuity and the “certain and life” annuity.

12. Who will the change affect?

This change will affect any participant who receives retirement benefits on or after January 1, 2018 and who elects to receive a lump sum payment.

The change will not affect you if:

- You elect to receive monthly payments and not a lump sum, or

- You plan to retire on or before December 1, 2017 and elect to receive a lump sum payment or any other option. Note: you must satisfy all of the deadlines established by the Pension Administration Division. See a following question regarding deadlines

13. What are the deadlines I need to meet if I want to receive a lump sum payment under original assumptions?

Employees must submit retirement applications to the Pension Administration Division four months before an employee plans to retire. Employees who want to retire and receive a lump sum payment calculated under original assumptions must apply for retirement by August 15, 2017, and retire by December 1, 2017.

Below are deadlines you must meet if you plan to retire on or before December 1, 2017.

| Deadlines | Action |

| February to April 2017 | Estimate your benefits. To see the effect of the change on lump sums paid after January 1, 2018, use the lump sum calculator. Instructions for the using the calculation can be found here. |

| April to June 15, 2017 | Contact Pension Administration for a retirement appointment if retiring by December 1, 2017. |

| July 17, 2017 | Recommended date to submit completed retirement application to Pension Administration to retire under current Plan Provisions |

| August 15, 2017 | Last day to submit completed retirement application to Pension Administration to retire under the current Plan Provisions |

| November 30, 2017 |

Last day you may work for the City. You must stop work by 11:59 p.m. November 30. If you work a shift, you cannot work any hours on December 1. |

| December 1, 2017 | Last date to retire under the Plan and receive a lump sum using the current Plan assumptions |

| January 1, 2018 | Effective date of the change. Any benefits paid on or after January 1, 2018 will be paid under the new plan provisions. |

All completed applications must be received in the Pension Administration Division office located in City Hall Room 1400 no later than 5 p.m. on August 15, 2017, if you plan to retire on or before December 1, 2017.

14. What is the lump sum estimator and where can I find it?

The lump sum calculator is available on the Pension web page to help calculate the difference in a lump sum payment paid in 2017 and one paid in 2018. This calculator allows employees retiring in 2018 or later to estimate the decrease in the lump sum payment under the change. Instructions for the using the calculation can be found here.

Please use the calculator to run your own estimates. Pension staff are not able to calculate lump sum payment estimates.

15. Who participates in the Supplemental Retirement Plan?

The City maintains the Plan for regular, full-time General Schedule Employees, Deputy Sheriffs, Medics, and Fire Marshals. The plan also covers regular, part-time General Schedule employees who are scheduled to work 50% time or more. Additionally, the Plan covers state employees working at the Alexandria Health Department and in several other City departments as well as the Mayor and other members of City Council.

16. Were any other changes made to the Plan?

The lump sum interest rate change was presented to City Council as a part of a docket agenda item that included additional administrative and technical updates.

The additional changes were administrative or technical in nature that do not affect Plan benefits, contributions, eligibility, or retirement payment elections. Pension plans often make such administrative and technical changes to clarify administrative procedures and to include them in the Plan Document for all to read. A Plan Document is the formal, written instrument that establishes a retirement plan and its provisions and describes how the plan is administered. The Plan Document as well as information on the additional administrative and technical changes can be found on the Pension webpage on AlexNet.

17. Does the change affect VRS benefits?

The change has no effect on VRS, including the PLOP (partial lump sum payment) option available within VRS. The City cannot makes changes to VRS. The change will only affect the Supplemental Retirement Plan.

18. Does the change affect the benefits under the Firefighters and Police Officers pension plan?

The change to the Plan does not affect the Firefighters and Police Officers Pension Plan benefits.

19. Where can I find more information about the change?

Visit the Pension Administration web page to view a video discussing the change, an announcement memo, the lump sum calculator, a list of employee meetings, and other information.