Deputy Sheriffs, EMTs, and Fire Marshals

Information for New and Potential Employees

Important information regarding payroll deducted contributions for new employees or employees new covered by the Virginia Retirement System.

Important Notice Regarding Changes to Retirement Plans for Deputy Sheriffs

Changes are being made to the City of Alexandria’s Supplemental Retirement plan effective on January 1, 2026.

The two changes are:

- Impacts ALL Supplemental Plan Employees – Update the Required Beginning Date language to comply with Secure 2.0

- Impacts the City’s Sheriff and Deputy Sheriffs – Update the retirement eligibility to match the retirement eligibility under the VRS Enhanced Hazardous Duty Plan.

Required Minimum Distribution (RMD) language to comply with Secure 2.0 – impacts ALL City of Alexandria Supplemental Plan Employees:

The required minimum distribution (RMD) age is increasing to bring the plan in compliance with the regulations required in Secure 2.0

The SECURE 2.0 Act of 2022, signed into law on December 29, 2022, as part of the federal Consolidated Appropriations Act, 2023, contains over 90 provisions impacting the rules for employer-sponsored defined benefit (DB) plans. The act requires that DB plans formally amend their plans by December 31, 2026. The table below summarizes the recent changes to the RMD age.

*The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act)

The proposed plan amendment includes language that would increase the RMD age and bring the Plan into compliance with the federal regulations as required in Secure 2.0.

Retirement eligibility under the Supplemental Retirement Plan for the Sheriff and Deputy Sheriffs:

In January 2020 the City’s Deputy Sheriff’s began to participate in the Virginia Retirement System’s (VRS) Enhanced Hazardous Duty Plan. One of the benefits of participating in the VRS Enhanced Hazardous Duty Plan is improved retirement eligibility under the VRS Plan.

In the FY2026 Approved budget City Council funded an amendment to improve the Deputy Sheriff’s retirement eligibility under the Plan to match their retirement eligibility under the VRS Enhanced Hazardous Duty Plan.

The proposed plan amendment would improve the Deputy Sheriffs’ and the Sheriff’s Normal Retirement eligibility to age 60 with 5 years of service or age 50 with 25 years. Deputy Sheriffs and the Sheriff would be eligible for Early Retirement at age 50 with 5 years of service. Participants choosing to retire under early retirement provisions will have their benefit actuarially reduced to be equivalent to the Plan.

The attached chart compares the current retirement eligibility and updated retirement eligibility in the proposed amendment.

| CURRENT: Supplemental Deputy Sheriff, Medic, Fire Marshal | PROPOSED: Supplemental Deputy Sheriff | |

| Normal Retirement | age 65 & 5 yos age 50 & 25 yos | age 60 & 5 yos age 50 & 25 yos |

| Early Retirement | age 55 & 5 yos | age 50 & 5 yos |

If you have any questions about the plan changes please reach out to the City’s Pension Team at retirement@alexandriava.gov

Changes are being made to the retirement plans for City Deputy Sheriffs effective January 1, 2020. The changes include:

- VRS retirement benefits will change to the VRS Enhanced Hazardous Duty benefits

- Supplemental Retirement Plan contributions will change from 0% to 1.5%

It is important that you read this entire document if you plan to retire in the current year.

Details on VRS and Supplemental Retirement Plan Changes

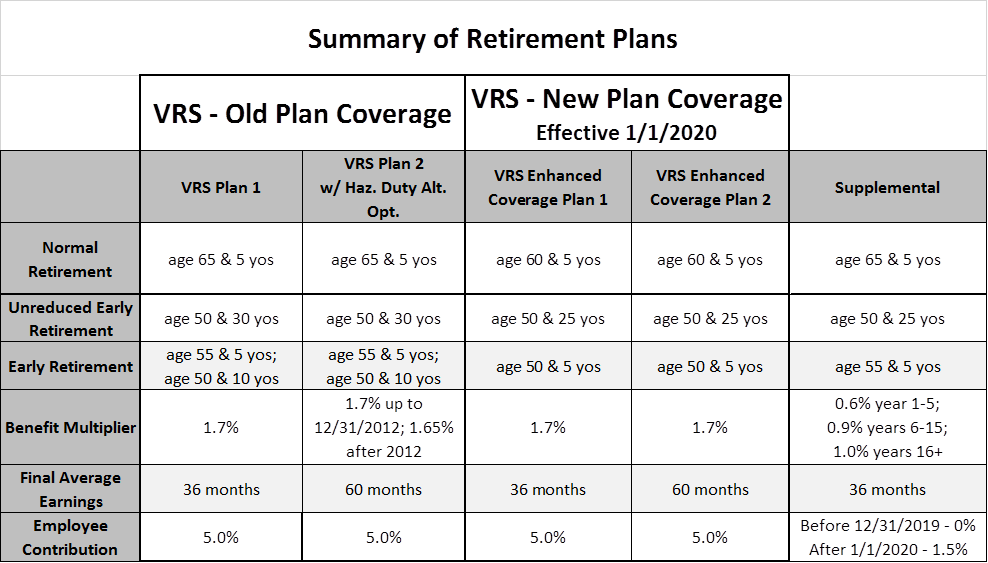

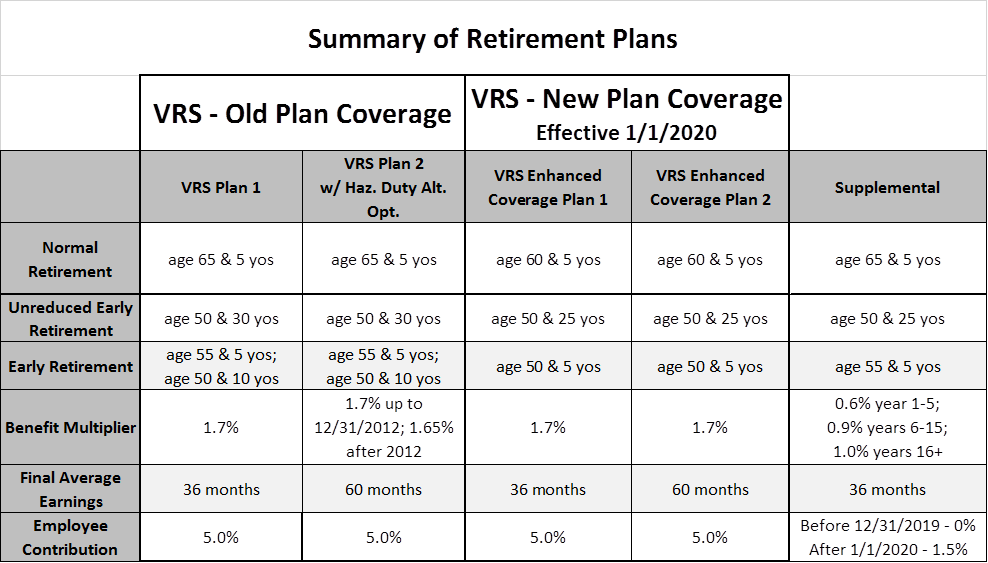

On November 12, 2019, City Council adopted a resolution to provide Deputy Sheriffs the VRS Enhanced Hazardous Duty benefits beginning January 1, 2020. The VRS Enhanced Hazardous Duty benefits provides Deputy Sheriffs a VRS unreduced retirement benefit as early as age 50 years with at least 25 years of service or at a normal retirement benefit as early as age 60 years with at least five years of service. Early retirement benefits are available at age 50 with five years of service. The following chart summarizes the changes to VRS benefits for Deputy Sheriffs.

City of Alexandria Deputy Sheriffs will not be eligible to receive the VRS supplement to Enhanced Hazardous Duty benefits because Deputy Sheriffs already participate in the City of Alexandria Supplemental Retirement Plan. The City’s Supplemental Retirement Plan provides a lifetime monthly pension whereas the VRS supplement is only paid until the employee reaches normal retirement age under Social Security (currently between ages 66 and 67).

Covering Deputy Sheriffs under the VRS Enhanced Hazardous Duty benefits will increase City costs by about 10%. City Council also adopted a change requiring Deputy Sheriffs to share in the increased costs and contribute 1.5% more toward their retirement benefits. The 1.5% contribution will go toward the City’s Supplemental Retirement Plan. The 1.5% contribution deduction will be identified as “Sup Sheriff Ret.” beginning with the January 17, 2020 paycheck.

Effective Date of VRS Change

The change to VRS is effective January 1, 2020. However, to be eligible to retire under the Enhanced Hazardous Duty benefits Deputy Sheriffs must work at least one calendar month past this date and pay full VRS contributions for the month.

As of January 9, 2020, the change has not been programmed in the VRS retirement estimator or the retirement application systems. VRS is working with the City’s Pension Administration Division to incorporate the change into their systems as soon as possible. Pension will notify the Sheriff’s Office when the VRS estimator and retirement systems have been updated.

Any Deputy Sheriff planning to retire in 2020 needs to take action:

- During the period February 1 – 28 email retirement@alexandriava.gov to notify Pension of your planned retirement date and to schedule an initial retirement appointment.

- Pension will discuss the steps you need to take now to be able to retire by the date you are planning.

Even though VRS is not yet able to provide a timeline for processing retirements in the current year, Pension needs to take some processing steps soon if you are going to retire in the current year.

Employees Need to Meet with Pension Staff One Year in Advance of Retirement

Employees who plan to retire should be meeting with Pension Division staff on two dates:

- One year before planned retirement date for a preliminary retirement appointment to discuss leave pay options and any divorce while employed with the City; and

- Four months before planned retirement date to formally apply to retire.

If you are planning to retire in the next twelve months, please start looking for the following documents that you will need to provide to Pension staff in order to apply to retire:

- Proof of your birth which could be a copy of a passport, birth certificate, hospital birth record, or other record that Pension will accept;

- Proof of birth for your spouse/other person if you will elect to receive a survivor pension;

- Copy of divorce document and any agreements referenced in the divorce document if you divorced while working for the City; and

- You will also need to provide a voided check as part of your retirement application.

Deputy Sheriffs May Also Participate in Two Voluntary Retirement Savings Plans

Deputy Sheriffs may also contribute to two voluntary retirement savings plans: 1) the City 457 Deferred Compensation Plan, and 2) the Payroll Deduct Roth IRA Plan. MissionSquare is the City record keeper for these plans. Contributions to 457 are deducted from paychecks on a pre-tax basis which helps to reduce taxable income for the current year. Money will be taxable when withdrawn from the 457 Plan. Contributions to the Roth IRA plan are deducted on an after-tax basis. Earnings may not be taxed if the employee 1) has the account at least five years, and 2) withdraws money after age 59 ½.

Additional City Benefits May Be Available in Retirement

In addition to the benefits provided by the two retirement plans, Deputy Sheriffs may be eligible for City insurance benefits (health, life, dental, and vision) in retirement. The City Human Resources manages the insurance benefits. Please contact Benefits at 703.746.3777 for answers to questions regarding these benefits.

Announcements

Please check back soon for announcements.

Seminars, Workshops, and Webinars

Virtual Retirement Workshops for Employees Retiring in the Next Two Years.

To view the recorded virtual VRS retirement workshop held on February 16, 2021 please click here. The presentation workbook can be found here.

Webinars, Seminars, and Financial Planning Consultations with MissionSquare's team of Certified Financial Planners

MissionSquare the record keeper for the City 457 Deferred Compensation Plan and the Payroll deduct Roth IRA Plan offers education opportunities on a monthly basis. The webinars are conducted by MissionSquares’s team of Certified Financial Planners.

Please see the link below for all upcoming webinars.

Please contact the Pension Administration Division if you have any questions retirement@alexandriava.gov

Be sure to obtain advance approval from your supervisor if you plan to attend a workshop during your schedule work hours.

For reasonable disability accommodation, contact Retirement@alexandriava.gov or 703.746.3906, Virginia Relay 711.

Financial Planning Consultations available with Certified Financial Planner Steve Taylor.

Steven Taylor

Phone: (866) 838 - 6661

Email: staylor@icmarc.org

Schedule an Appointment

Retirement Benefits Summary and Benefits Guides

- Retirement Summary for Medics, and Fire Marshals

- Retirement Summary for Deputy Sheriffs

- Retirement checklist provides information on steps you need to take to retire from the City retirement plans with estimated due dates.

Virginia Retirement System (VRS) Employer Code 55200

The City provides retirement and disability retirement benefits under VRS for regular, full-time employees. The VRS website, forms and publications may refer to other benefits that VRS provides to participating employers. However, the City does not participate in any benefits other than the ones described here.

Forms and Publications

- Applying for Service Retirement has instructions. The following forms needs to be completed to apply for a VRS retirement:

- Direct Deposit Form

NOTE:Employees must submit these forms to the Pension Administration Division.

Applying for Disability Retirement has instructions and the following forms that an employee needs to apply for a disability retirement from VRS:

-

- Application

- Explanation of Disability

- Physician's Report

- Employer Information

- Tax Withholding

- Direct Deposit Forms

NOTE: Employees applying for a disability retirement should contact the Pension Administration Division as soon as possible. Designation of Beneficiary - Complete Part A on page one, but not Part B. In Part C, you may list individual beneficiaries or check box 8, but do not do both. If you choose box 8 you are requesting death benefits be paid according to state law. The instructions provide information how benefits are paid according to the law of Virginia. Mail your completed form to the Pension Administration Division in Room 1400, City Hall, mailbox 42.

- Contact Human Resources if you wish to designate, or change the designation of, the beneficiary of your City life insurance benefit.

- VRS Handbook

VRS Website

- VRS website View information on the Member tab. You are able to view your personal information and create retirement estimates when you log onto myVRS.

Supplemental Retirement Plan Contract Number 16741

Documents

- Plan Document as of January 1, 2014

- First Amendment - adopted by City Council on May 4, 2017

- Second Amendment - adopted by City Council on May 3, 2018

- Third Amendment - adopted by City Council on January 15, 2019

- Fourth Amendment - adopted by City Council on November 25, 2025

- Plan Document as of January 1, 2009

-

- First Amendment- adopted by City Council on June 9, 2009

- Second Amendment- adopted by City Council on Jun 22, 2010

- Third Amendment - adopted by City Council on May 10, 2011

- Fourth Amendment - adopted by City Council on June 16, 2012

-

Empower Retirement (Formerly Prudential)

Empower administers the Supplemental Retirement Plan. Employees may visit the Prudential website to calculate retirement benefits and to view information on retirement planning.

- Empower Website and creating pension estimates

- Retirement Education provides information on retirement planning and investing.

For help with registering and using the Empower website, contact :

Empower

1.877.778.2100

Monday - Friday, 8 a.m. - 9 p.m.

Supplemental Retirement Plan Board

The Supplemental Retirement Plan has a Pension Board made up of representatives of Deputy Sheriffs, Medics, Fire Marshals, General Schedule employees as well as City management. The Board oversees the investments of the pension plan. Meetings are open to the public. Click HERE to find additional details on the Supplemental Retirement Board.

Retirement Income Plan Contract 719118

- Plan Document

- First Amendment adopted by City Council on May 10, 2011

- Second Amendment adopted by City Council on May 10, 2011

- Third Amendment adopted by City Council on May 10, 2011

Update December 9, 2011 regarding transfer of accounts to the 457 Deferred Compensation Plan with MissionSquare.

- Information provided at an earlier date regarding these changes:

- Letter from MissionSquare regarding tax treatment of money rolled over from the Retirement Income Plan to the 457 Plan

- Attachment to MissionSquare letter listing exceptions to ten percent additional tax on rollover money

- Internal Revenue Service Tax Topic 558 regarding tax on early distributions from retirement plans

- Fees 457 Plan funds charged January 31, 2011

- Fees Retirement Income Plan funds charged December 31, 2011

MissionSquare Payroll Deduction Roth IRA Account Number 705691

The City is now providing employees an additional way to save for retirement. Employees who enroll in a Payroll Deduction Roth IRA account with MissionSquare will be able to make contributions to that Roth IRA account using payroll deductions. For more details click on the following:

- Informational Video on the Payroll Roth IRA and MissionSquare

- Details on the Payroll Roth IRA

- Brochure on the Payroll Roth IRA

Deferred Compensation Plan Plan Number 300832

The City sponsors the 457 Deferred Compensation Plan (457 Plan) with MissionSquare to help employees save for retirement. A 457 plan is a savings plan available to state and local government employees that allows an employee to save through payroll-deducted contributions on a pre-tax basis. This means the contributions are deducted from the paycheck before federal and state taxes are withheld and the amount of taxable income is reduced by the amount of the contribution. Earnings also accumulate on a tax-deferred basis. Taxes are paid on contributions and interest when money is withdrawn.

For those just starting out, payroll-deducted contributions can be as little as $10 per pay period and up to the annual deferral limit for the year. The Internal Revenue Service determines the maximum deferral limit each year.

Log onto the MissionSquare website, to view your account information, information on the funds, and to learn about investing. You will need to use the City Plan Number, 300832, the first time you log onto the website.

To request an Enrollment Kit, email retirement@alexandriava.gov or call 703.746.3906.

Online Enrollment directions.

Changing Your Contribution

If you want to change your contribution amount to the new deferral limit, or make any other change to your contribution amount, you will need to complete a 457 Deferred Compensation Plan Amount of Deferral Change Form. Complete the form with your new contribution amount and send it to:

Pension Administration Division

100 N Pitt Street, Suite 225

Catch-Up Options

Employees have two opportunities to catch-up on contributions that they did not make in the past.

- Age-50 Catch-Up: Any employee who turns 50 or older during the year is eligible.

- Pre-Retirement Catch-up: Available to employees who are eligible to retire within the next three years with an unreduced retirement benefit. The amount that you may actually contribute under this provision is determined by subtracting the actual amount you have already contributed from the maximum allowed. This provision is complicated for employees who wish to defer some or all of their leave payout at retirement.

For more information on the Pre-Retirement Catch-Up and deferring leave payout, contact:

Pension Administration Division

100 N Pitt Street, Suite 225

703.746.3906

The booklet 457 Deferred Compensation Plan Catch-Up Provision Packet provides more information on the Age-50 Catch-up and the Pre-Retirement Catch-up provisions.

MissionSquare Representative and Investor Relations

The City's MissionSquare representatives, Antoinette Guy-Wharton and Shantel Washington, are available to meet employees to discuss the 457 Plan. They will make appointments to meet employees at their locations or over the phone. To arrange a meeting or talk about the plan, call:

Antoinette Guy Wharton

1.866.283.1762

Monday-Friday, 8:30 a.m. to 9 p.m.

For answers to questions or assistance with using the website call:

MissionSquare Plan Services

1.800.669.7400

Monday-Friday, 8:30 a.m. to 9 p.m.

Forms and Publications

- Forms and Publications (City Plan Number 300832)

Social Security

Retired Employee Information

- Why am I receiving a W-2 if I am a City Retiree? This information applies to retirees who have City life insurance benefits.

- Virginia Retirement System (VRS) Retiree Web Page

- Contact Information for the City pension retirement and 457 Deferred Compensation plans.

- Contact the Virginia Retirement System (VRS) at 1.888.827.3847 Monday - Friday from 8:30 a.m. to 5 p.m. if you have questions on your monthly VRS benefit, 1099s (year end tax information), to change your address or tax withholdings, or to report the death of a retiree or beneficiary receiving a monthly pension from the Virginia Retirement System (VRS).

- Contact Empower Retirement at 1.877.778.2100 from 8 a.m. to 9 p.m. if you have questions on your monthly Supplemental Retirement Plan benefit paid by Empower, 1099s (year end tax information), to change your address or tax withholdings, or to report the death of a retiree or a beneficiary receiving a monthly pension from the Supplemental Retirement Plan (often called the City Plan). Empower is the administrator for employees who retired on or after July 1997.

- Contact Principal at 1.800.247.7011 from 8 a.m. to 6 p.m. if you have questions on your monthly Supplemental Retirement Plan benefit paid by Principal, 1099s (year end tax information), to change your address or tax withholdings, or to report the death of a retiree or beneficiary receiving a monthly pension from Principal. Principal is the administrator of the Supplemental Retirement Plan for employees who retired prior to July 1, 1997.

- Contact Empower Retirement at 1.877.778.2100 from 8 a.m. to 9 p.m. if you have any questions on the Retirement Income Plan for Deputy Sheriffs, Emergency Rescue Technicians/Medics, and Fire Marshals.

- Contact MissionSquare at 1.800.669.7400 from 8:30 a.m. to 9 p.m. to inquire about the 457 Deferred Compensation Plan. Employees had the option of participating in this plan by making payroll-deducted contributions.

- Contact the City Pension Administration Division at 703.746.3906 for further information on the retirement plans.

- Contact the Human Resources Benefits and Records Division at 703.746.3785 for inquiries on health and life insurance benefits. You may also find information on those benefits on their website.